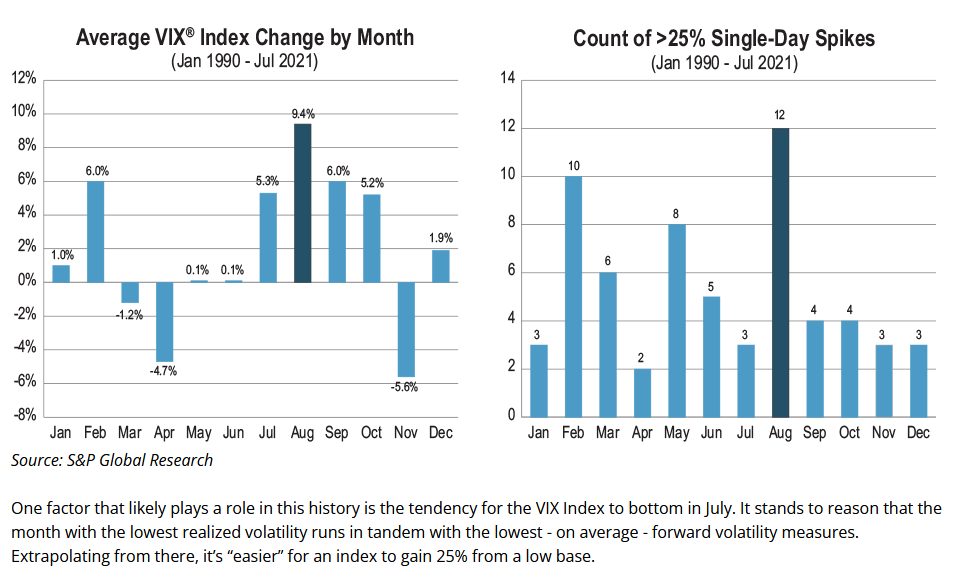

It's true that the month of August has historically been associated with higher volatility in the financial markets, and this is often reflected in the VIX (Volatility Index). The VIX, often referred to as the "fear gauge," measures market expectations of near-term volatility as implied by S&P 500 index options. Higher VIX values indicate increased market uncertainty and fear, which often leads to sharp market movements.

see: https://www.cboe.com/insights/posts/inside-volatility-trading-a-day-a-week-a-year-a-decade/

August's reputation for higher VIX peaks is grounded in historical patterns of market behavior, influenced by seasonal factors, liquidity issues, and significant economic or geopolitical events. While these factors make August a potentially volatile month, understanding these dynamics can help traders better navigate the markets during this period.